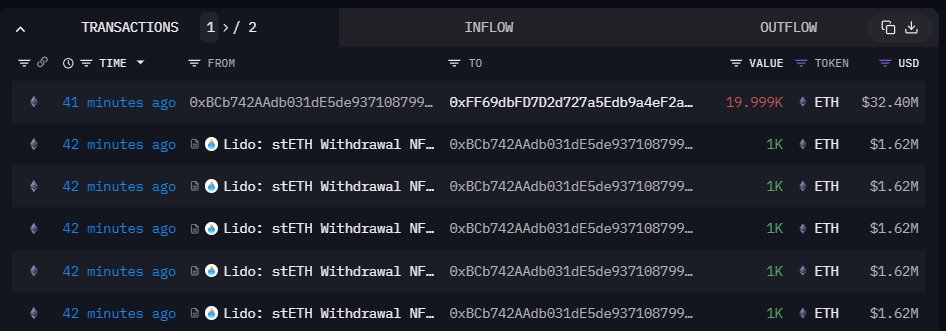

A crypto wallet associated with Justin Sun, the co-founder of Tron, a smart contract platform, has moved 20,000 Ethereum (ETH) worth roughly $32.4 million from Lido Finance, a liquidity staking platform. Funds were transferred to Binance, the world’s largest crypto exchange, trading volume and client count.

The transaction, executed in a single batch, was captured by The Data Nerd, an analysis platform, and shared on X on October 5. As it is, Ethereum (ETH) is under pressure, looking at the performance in the daily chart.

Ethereum Drops 4%, Are Bears Flowing Back?

Trackers show that the coin is down roughly 4% in three days, confirming sellers of October 2. Notably, the daily chart has a double bar formation with the bear candlestick of October 2, completely reversing buyers of October 1.

This arrangement suggests that bears could be in control, especially considering the draw-down of the past few trading days and the level of participation on October 2 when the coin slipped.

In technical analysis, losses at the back of increasing volumes often point to high participation. If prices are rising, then the coin in question could rally. Conversely, a sell-off could worsen if the bar had high trading volumes.

It is also unclear whether Justin Sun plans to sell ETH after transferring coins to exchanges. Crypto transfers to centralized exchanges, which support many stablecoins like USDT and others, are often associated with sell-offs.

Market participants may interpret such movements as bearish, fueling the sell-off, subsequently heaping more pressure on prices. ETH is now at a one-week low.

Justin Sun Shuffling ETH In 2023

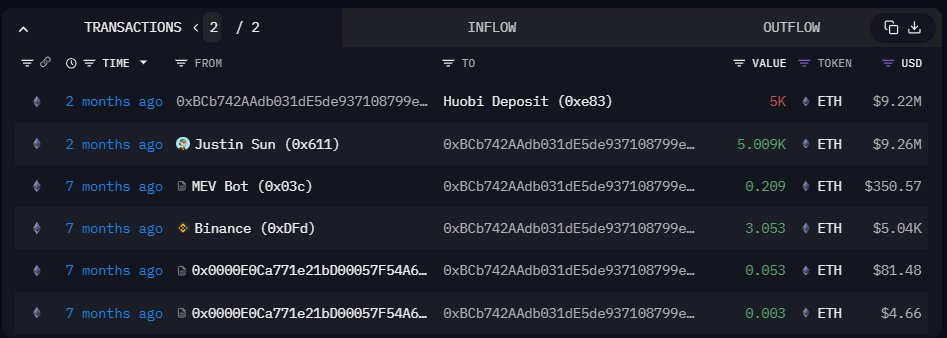

The Data Nerd observes that prices fell the last time the wallet moved ETH to Huobi, which has since rebranded to HTX. In August, the wallet moved 5,000 ETH to HTX. The deposit came a week before ETH prices crashed 12%.

Bitcoin and Ethereum prices fell sharply in mid-August, causing a “cascade liquidation” that spooked investors. ETH bulls have since failed to reverse those losses. Considering the relatively low trading volumes in the last two months, prices are still boxed within the August 17 trade range, a bearish signal.

In late February 2023, Justin Sun staked 150,000 ETH, worth roughly $240 million, to Lido Finance. The transfer remains the largest single-stay transaction, forcing the liquidity staking provider to activate the Staking Rate Limit feature, capping the amount of coins one can stake at 150,000 ETH.

Lido Finance said the feature is more of a “safety valve” that “addresses possible side-effects such as rewards dilution, without needing to pause stake deposits explicitly.”

Feature image from Canva, chart from TradingView