Crypto analyst Javon Marks has highlighted several metrics that have turned bullish for Ethereum (ETH). The analyst noted that one of these metrics suggests an all-time high (ATH) for the second-largest crypto token.

Bullish Metrics For Ethereum

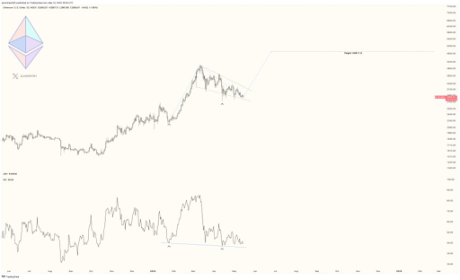

Marks remarked in an X (formerly Twitter) post that the bull flag-like price structure has formed on the Ethereum chart. He added that higher lows are forming in Ethereum’s price action, which is also a bullish signal as it suggests a strong resistance to downward trends. Meanwhile, the analyst claims lower lows in the Relative Strength Index (RSI) indicate a hidden bullish divergence with Ethereum’s price.

Related Reading

Marks then raised the possibility of Ethereum hitting a new ATH, stating that the “bull flag breakout might lead into new all-time highs and be of major service in many Altcoin progressions.” Before then, he claimed that Ethereum could soon experience a larger price breakout, making the crypto token experience a 63% upside to $4,811.

Crypto analyst Michaël van de Poppe also recently suggested that Ethereum could make a major move soon enough and lead altcoins to make new highs. According to him, this will be triggered by the news surrounding the Ethereum ETF, as he expects that to be the “rotation for the Altcoins.”

However, Ethereum also risks experiencing a significant decline, considering reports that the Securities and Exchange Commission (SEC) might reject the Ethereum ETF applications. Crypto analyst James Van Straten stated that a rejection of the Spot ETF “sends the ETHBTC ratio lower 0.047 to 0.03 as a long-term projection.”

This was one of the reasons why the analyst stated that “Ethereum looks like it’s going to the grave.” He also alluded to the fact that ETH has become inflationary with the Decun upgrade reducing transaction fees, which has ultimately reduced ETH’s burn rate.

Things Aren’t Looking Good For ETH

Crypto analyst Derek recently mentioned that “Ethereum dominance and recent performance are heading toward their worst ever.” He noted that attention has turned to Bitcoin due to the reports about a potential rejection of the Ethereum ETF and securities status, which has put pressure on investment sentiment. According to him, this has caused the “imbalance in dominance” to reach its worst point.

Related Reading

Derek further noted that Ethereum’s unimpressive price action is affecting other altcoins, as their prices are “depressed.” He also claimed that the prices of layer two coins “continued to be under pressure.” The analyst suggested that things could get worse, as the ETH/BTC chart shows a downward wedge pattern in progress. He claims that altcoins can only “breathe” if Ethereum can escape this pattern quickly.

At the time of writing, Ethereum is trading at around $2906, down in the last 24 hours according to data from CoinMarketCap.

Featured image from Metaverse Post, chart from Tradingview.com