Ethereum liquid staking platforms are making waves in the decentralized finance (DeFi) ecosystem. Recent on-chain reports have revealed that liquid staking protocols have recorded a new milestone in the number of Ether (ETH) staked, reaching a staggering 12 million ETH mark in just a few days.

Ethereum Liquid Staking Gains Momentum

With Ethereum 2.0 thriving, liquid staking protocols in the DeFi ecosystem have been growing rapidly despite recent market volatility.

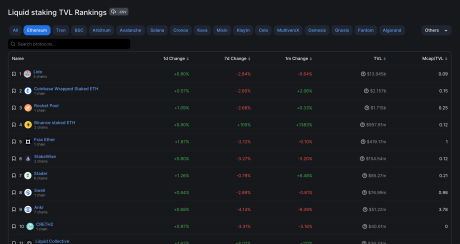

Research data from DeFi TVL aggregator, Defillama, revealed on Monday, September 25, the tremendous growth of Ethereum holdings in liquid staking platforms. According to the data, the ETH in liquid staking protocols has risen to approximately 12.31 million and may continue rising.

Reports uncovered that a staggering 370,000 ETH were staked in just five days, allowing liquid staking protocols to reach their current 12 million mark. Liquid staking platforms like Lido, Rocket Pool, Coinbase, and Binance are among the list of prominent protocols that led to the recent upsurge in Ether staking.

According to Defillama TVL rankings, Lido holds the top spot for the amount of Ethereum staked with a TVL of $13.997 billion in liquid staking. The protocol secured over 8 million Ether on September 20, and another 30,000 after that.

Lido Finance dominates ETH liquid staking | Source: DeFiLlama

Coinbase is presently ranked second in Defillama’s TVL rankings, holding approximately $2.155 billion, a significant gap from Lido’s TVL.

Coinbase has about 1.3 million Ether presently in its reserve. Whereas, Rocket Pool holds the third position in TVL rankings and has increased its Ether holdings from 940,496 to 945,402.

Binance Liquid Staking Platform Takes The Lead

Binance liquid staking platform has been the driving force behind the recent spike in ether influx in liquid staking protocols in the DeFi ecosystem.

According to reports, Binance added a startling amount of ether to its already substantial ether reserves. The liquid staking platform which previously recorded 445,000 ETH in its reserve, added 318,605 ETH and now holds 764,105 ETH. Research data have revealed that Binance amassed a considerable amount of ETH tokens to support its staking token, Wrapped Beacon ETH (WBETH).

In the last three months, the DeFi ecosystem recorded a liquid staking valuation above $20 billion evaluating various protocols in the DeFi ecosystem. Following this, Defillama’s September data revealed liquid staking protocols now hold $20.5 billion in assets, increasing by a staggering 293% from previous lows in June 2022.

Although the key protocols steering the surge are Lido, Binance, and Rocket Pool. Other upcoming liquid staking protocols like Davos and InQubeta are persisting, driven by the Ethereum 2.0 upgrade and investors desire to maximize their earnings through Ethereum staking.

ETH price at $1,587 as liquid staking surges | Source: ETHUSD on Tradingview.com

Featured image from iStock, chart from Tradingview.com